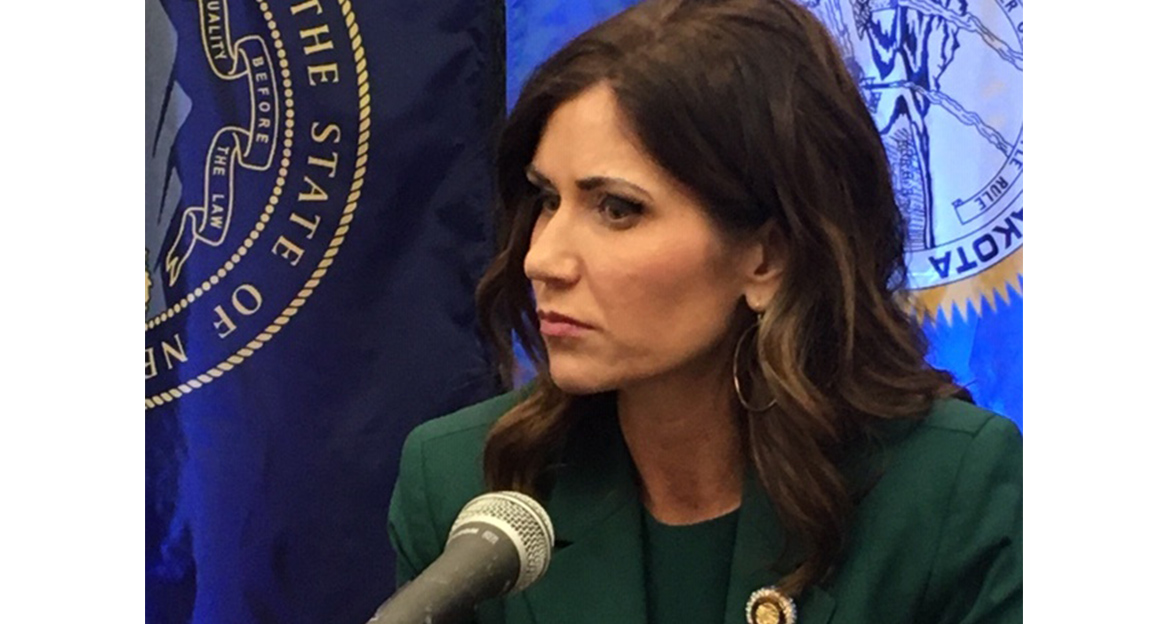

PIERRE, S.D. – This session, Governor Kristi Noem has signed 31 bills into law, including Senate Bill 37, her legislation to repeal the bingo tax.

“We are eliminating a ridiculous tax – the bingo tax,” said Governor Noem. “This tax primarily impacted veterans and elderly South Dakotans, and I am glad that we are getting rid of it.”

She has issued one veto – Senate Bill 76. The Governor’s veto message to the legislature reads as follows:

Dear Mr. President and Members of the Senate,

I respectfully return to you Senate Bill 76 with my VETO. Senate Bill 76 is an Act to revise certain provisions regarding the minimum amount of a lottery prize that is subject to setoff.

When the Lottery was created, a debt setoff system was established where debts could be deducted by the amount won by a winning lottery ticket. Some of those debts are past due child support payments. While this bill may appear harmless, increasing the setoff amount will have consequences on families and helps people avoid their obligations.

In the last two years, 44 prizes from winning lottery tickets were under $599 and helped pay past due child support obligations. This resulted in South Dakota families receiving resources that were due to them. Under this legislation, those families may not have received that support to buy essentials.

While I support the current law for efficiency purposes, increasing that amount automatically paid to $599 goes too far. South Dakota must stand as an example for the rest of the country that we put the well-being of our children before convenience. Our focus must be on leading for South Dakota’s next generation.

For these reasons, I oppose Senate Bill 76 and ask that you sustain my veto.

The other bills signed into law include:

• SB 5 revises acceptable conduct related to the medical use of cannabis.

• HB 1010 revises certain references to the Internal Revenue Code.

• HB 1011 revises the application process for the reduction of tax on dwellings owned by paraplegics.

• HB 1025 updates legal holidays in South Dakota.

• HB 1035 allows the Department of Agriculture and Natural Resources to collect receipts from timber sales on federal lands and disburse those receipts according to federal law.

• HB 1043 revises renewal and licensing requirements for plumbers.

• HB 1065 repeals references to nonresident holders of concealed pistol permits.

• HB 1104 revises provisions to the location of courtroom facilities.

• HB 1105 allows for a good cause exception to the time for an involuntary commitment hearing.

• SB 28 disqualifies for life any person from driving a commercial vehicle who is convicted of a felony offense involving human trafficking.

• SB 35 increases penalties for actions related to grain transactions.

• SB 36 requires financial security for the decommissioning of solar facilities.

• SB 38 prohibits a grain broker from engaging in certain transactions or activities.

• SB 39 reduces the period for filing claims upon the revocation of a grain buyer license.

• SB 71 revises certain provisions related to the partners in education tax credit program.

• SB 74 revises provisions regarding out-of-service motor carrier violations.

• SB 80 exempts the provision of electricity through electric charging stations from the definition of electric utility.

• HB 1002 revises certain provisions regarding the investments authorized for state public funds.

• HB 1009 revises certain provisions of the Higher Education Savings Plan Act.

• HB 1027 places certain substances on the controlled substances schedule.

• HB 1036 revises certain provisions regarding search warrants for tracking devices.

• HB 1046 revises the disposal fee for large-scale solid waste disposal facilities operated by political subdivisions.

• HB 1063 revises the approval process for state employee household moving allowances.

• SB 29 authorizes highway maintenance vehicles to operate at less than the posted minimum speed on interstate highways.

• SB 47 revises certain provisions regarding money transmission.

• HB 1003 updates references to certain federal motor carrier regulations.

• HB 1059 permits nonresponsive insurance producer applications to be deemed withdrawn as to not constitute a refusal or administrative action.

• HB 1062 revises a provision regarding when a license is not required of a person installing electric wiring.